What Counts As Residential Property For Cgt . — capital gains in france are subject to both cgt tax at a flat rate of 19% and social charges at a flat rate of 17.2% —a total of 36.2%. 28% on your gains from ‘carried interest’ if you manage an investment fund; 24% on your gains from residential property; if you sold a uk residential property on or after 6 april 2020 and you have tax on gains to pay, you can report and pay using a. — in broad terms, a person reporting gains on uk residential property must report the gain on a special return,. if your main home/principal residence is in france and you are a tax resident in france it is a legal obligation that you declare all your world/global income and. — since 6 april 2016 onwards there are now four different cgt rates for individuals and the rate applied will. Find out how much cgt you'll pay, when you have to pay it.

from www.studocu.com

— capital gains in france are subject to both cgt tax at a flat rate of 19% and social charges at a flat rate of 17.2% —a total of 36.2%. — since 6 april 2016 onwards there are now four different cgt rates for individuals and the rate applied will. Find out how much cgt you'll pay, when you have to pay it. if your main home/principal residence is in france and you are a tax resident in france it is a legal obligation that you declare all your world/global income and. 24% on your gains from residential property; — in broad terms, a person reporting gains on uk residential property must report the gain on a special return,. if you sold a uk residential property on or after 6 april 2020 and you have tax on gains to pay, you can report and pay using a. 28% on your gains from ‘carried interest’ if you manage an investment fund;

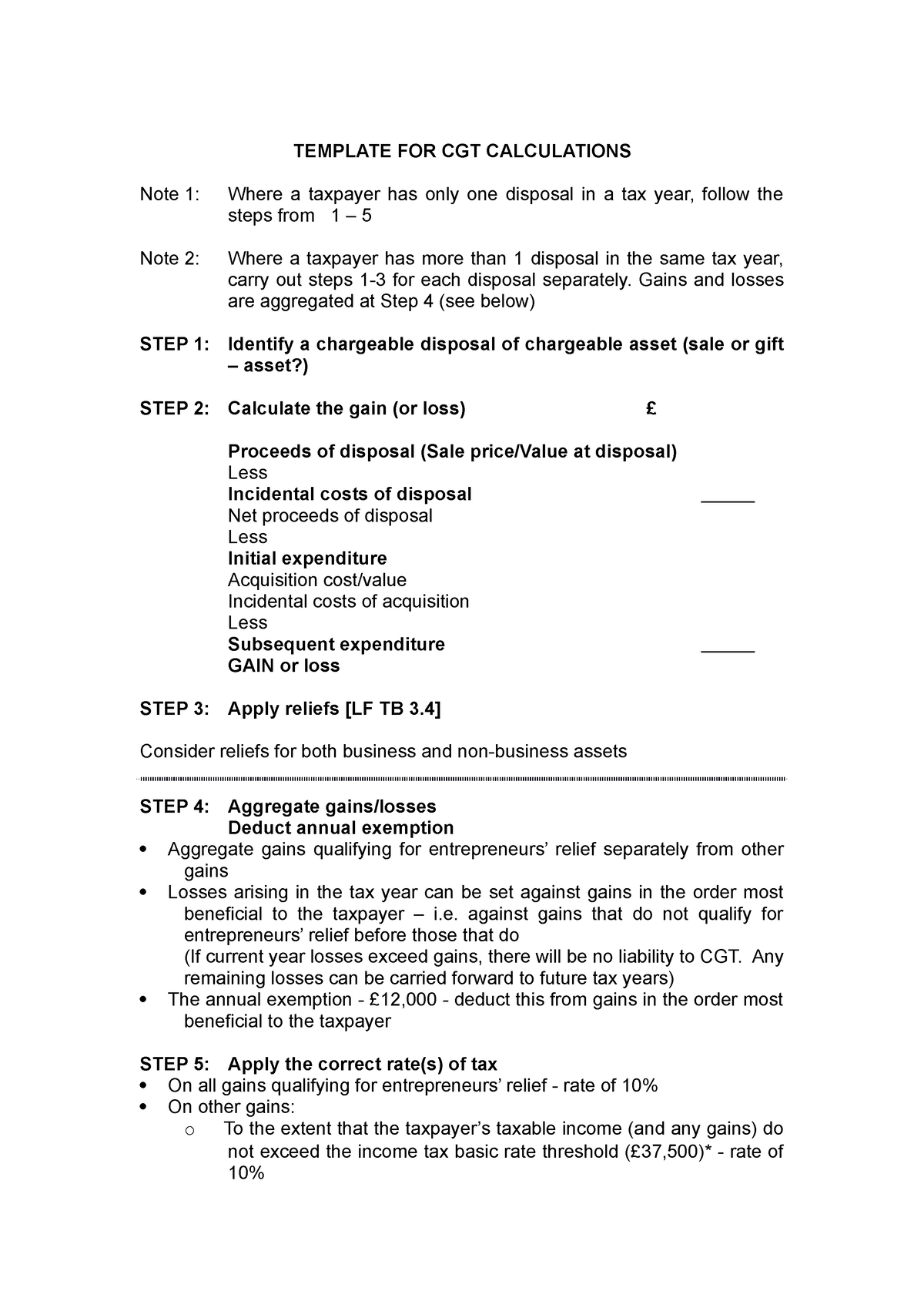

Template FOR CGT Calculations TEMPLATE FOR CGT CALCULATIONS Note 1

What Counts As Residential Property For Cgt — in broad terms, a person reporting gains on uk residential property must report the gain on a special return,. — since 6 april 2016 onwards there are now four different cgt rates for individuals and the rate applied will. Find out how much cgt you'll pay, when you have to pay it. — capital gains in france are subject to both cgt tax at a flat rate of 19% and social charges at a flat rate of 17.2% —a total of 36.2%. 28% on your gains from ‘carried interest’ if you manage an investment fund; — in broad terms, a person reporting gains on uk residential property must report the gain on a special return,. if your main home/principal residence is in france and you are a tax resident in france it is a legal obligation that you declare all your world/global income and. if you sold a uk residential property on or after 6 april 2020 and you have tax on gains to pay, you can report and pay using a. 24% on your gains from residential property;

From www.optimiseaccountants.co.uk

UK Capital Gains Tax Calculator (CGT) Selling Residential Property What Counts As Residential Property For Cgt — capital gains in france are subject to both cgt tax at a flat rate of 19% and social charges at a flat rate of 17.2% —a total of 36.2%. — in broad terms, a person reporting gains on uk residential property must report the gain on a special return,. — since 6 april 2016 onwards there. What Counts As Residential Property For Cgt.

From www.fkgb.co.uk

CGT Payment Window for Residential Property Gains FKGB Accounting What Counts As Residential Property For Cgt Find out how much cgt you'll pay, when you have to pay it. 24% on your gains from residential property; — since 6 april 2016 onwards there are now four different cgt rates for individuals and the rate applied will. if your main home/principal residence is in france and you are a tax resident in france it. What Counts As Residential Property For Cgt.

From propertyplanning.com.au

CGT Property Planning Australia What Counts As Residential Property For Cgt 24% on your gains from residential property; 28% on your gains from ‘carried interest’ if you manage an investment fund; Find out how much cgt you'll pay, when you have to pay it. if you sold a uk residential property on or after 6 april 2020 and you have tax on gains to pay, you can report and. What Counts As Residential Property For Cgt.

From www.eloquens.com

Residential Investment Property Acquisition Model 20 year Three What Counts As Residential Property For Cgt 28% on your gains from ‘carried interest’ if you manage an investment fund; — in broad terms, a person reporting gains on uk residential property must report the gain on a special return,. if you sold a uk residential property on or after 6 april 2020 and you have tax on gains to pay, you can report and. What Counts As Residential Property For Cgt.

From johnmtaylor.co.uk

CGT on Residential Property What Counts As Residential Property For Cgt if your main home/principal residence is in france and you are a tax resident in france it is a legal obligation that you declare all your world/global income and. 24% on your gains from residential property; — capital gains in france are subject to both cgt tax at a flat rate of 19% and social charges at. What Counts As Residential Property For Cgt.

From www.knowledgeshop.com.au

CGT & Property Online What Counts As Residential Property For Cgt — since 6 april 2016 onwards there are now four different cgt rates for individuals and the rate applied will. — in broad terms, a person reporting gains on uk residential property must report the gain on a special return,. — capital gains in france are subject to both cgt tax at a flat rate of 19%. What Counts As Residential Property For Cgt.

From www.taxfile.co.uk

New 30Day Rules for Capital Gains on Residential Property in the UK What Counts As Residential Property For Cgt — in broad terms, a person reporting gains on uk residential property must report the gain on a special return,. Find out how much cgt you'll pay, when you have to pay it. 28% on your gains from ‘carried interest’ if you manage an investment fund; if your main home/principal residence is in france and you are a. What Counts As Residential Property For Cgt.

From towersandgornall.co.uk

Budget 2024 Capital Gains Tax (CGT) on Residential Property Towers What Counts As Residential Property For Cgt 28% on your gains from ‘carried interest’ if you manage an investment fund; — in broad terms, a person reporting gains on uk residential property must report the gain on a special return,. — capital gains in france are subject to both cgt tax at a flat rate of 19% and social charges at a flat rate of. What Counts As Residential Property For Cgt.

From www.rossmartin.co.uk

CGT Residential property signpost www.rossmartin.co.uk What Counts As Residential Property For Cgt 28% on your gains from ‘carried interest’ if you manage an investment fund; — capital gains in france are subject to both cgt tax at a flat rate of 19% and social charges at a flat rate of 17.2% —a total of 36.2%. if your main home/principal residence is in france and you are a tax resident in. What Counts As Residential Property For Cgt.

From www.eloquens.com

Residential Investment Property Acquisition Model 20 year Three What Counts As Residential Property For Cgt if you sold a uk residential property on or after 6 april 2020 and you have tax on gains to pay, you can report and pay using a. if your main home/principal residence is in france and you are a tax resident in france it is a legal obligation that you declare all your world/global income and. . What Counts As Residential Property For Cgt.

From retiregenz.com

How To Calculate Cgt On Investment Property? Retire Gen Z What Counts As Residential Property For Cgt Find out how much cgt you'll pay, when you have to pay it. — capital gains in france are subject to both cgt tax at a flat rate of 19% and social charges at a flat rate of 17.2% —a total of 36.2%. if you sold a uk residential property on or after 6 april 2020 and you. What Counts As Residential Property For Cgt.

From www.wilson-partners.co.uk

Residential property Capital Gains Tax 60day reporting Are you on top What Counts As Residential Property For Cgt if you sold a uk residential property on or after 6 april 2020 and you have tax on gains to pay, you can report and pay using a. — since 6 april 2016 onwards there are now four different cgt rates for individuals and the rate applied will. — in broad terms, a person reporting gains on. What Counts As Residential Property For Cgt.

From www.thestanlee.com

Capital Gains Tax (CGT) on Residential Property for Individuals The What Counts As Residential Property For Cgt 28% on your gains from ‘carried interest’ if you manage an investment fund; if your main home/principal residence is in france and you are a tax resident in france it is a legal obligation that you declare all your world/global income and. — in broad terms, a person reporting gains on uk residential property must report the gain. What Counts As Residential Property For Cgt.

From www.moorethompson.co.uk

HMRC helpsheet to support residential property sellers with CGT rules What Counts As Residential Property For Cgt Find out how much cgt you'll pay, when you have to pay it. if your main home/principal residence is in france and you are a tax resident in france it is a legal obligation that you declare all your world/global income and. if you sold a uk residential property on or after 6 april 2020 and you have. What Counts As Residential Property For Cgt.

From www.studocu.com

Template FOR CGT Calculations TEMPLATE FOR CGT CALCULATION £ STEP 1 What Counts As Residential Property For Cgt if you sold a uk residential property on or after 6 april 2020 and you have tax on gains to pay, you can report and pay using a. 28% on your gains from ‘carried interest’ if you manage an investment fund; Find out how much cgt you'll pay, when you have to pay it. 24% on your gains. What Counts As Residential Property For Cgt.

From leaddeveloper.com

The Ultimate Guide To Property Investment Accounting What Counts As Residential Property For Cgt if you sold a uk residential property on or after 6 april 2020 and you have tax on gains to pay, you can report and pay using a. 24% on your gains from residential property; — since 6 april 2016 onwards there are now four different cgt rates for individuals and the rate applied will. Find out. What Counts As Residential Property For Cgt.

From www.eloquens.com

Residential Investment Property Acquisition Model 20 year Three What Counts As Residential Property For Cgt 24% on your gains from residential property; if your main home/principal residence is in france and you are a tax resident in france it is a legal obligation that you declare all your world/global income and. — capital gains in france are subject to both cgt tax at a flat rate of 19% and social charges at. What Counts As Residential Property For Cgt.

From www.charterwells.co.uk

30Days to pay CGT for Residential Property What Counts As Residential Property For Cgt — capital gains in france are subject to both cgt tax at a flat rate of 19% and social charges at a flat rate of 17.2% —a total of 36.2%. if you sold a uk residential property on or after 6 april 2020 and you have tax on gains to pay, you can report and pay using a.. What Counts As Residential Property For Cgt.